The Ultimate Guide To Broker Mortgage Calculator

Wiki Article

The Definitive Guide to Broker Mortgage Calculator

Table of Contents10 Simple Techniques For Broker Mortgage MeaningMortgage Broker Association Can Be Fun For EveryoneLittle Known Facts About Broker Mortgage Fees.The smart Trick of Mortgage Broker That Nobody is Talking AboutMortgage Broker Job Description Can Be Fun For AnyoneThe Ultimate Guide To Mortgage Broker AssistantWhat Does Broker Mortgage Fees Mean?Mortgage Broker Job Description Fundamentals Explained

What Is a Mortgage Broker? A home loan broker is an intermediary in between a banks that uses car loans that are safeguarded with actual estate and individuals curious about getting realty who require to obtain money in the form of a loan to do so. The home loan broker will certainly collaborate with both celebrations to get the specific accepted for the finance.A home loan broker commonly works with many various loan providers as well as can supply a selection of funding choices to the customer they work with. The broker will collect information from the private and go to multiple lenders in order to find the best possible funding for their customer.

The smart Trick of Broker Mortgage Calculator That Nobody is Discussing

The Bottom Line: Do I Required A Home Mortgage Broker? Collaborating with a home loan broker can conserve the customer time as well as effort during the application process, as well as potentially a lot of money over the life of the funding. Additionally, some loan providers work exclusively with mortgage brokers, meaning that debtors would have access to car loans that would or else not be available to them.It's crucial to examine all the fees, both those you might need to pay the broker, along with any charges the broker can help you avoid, when considering the decision to collaborate with a home loan broker.

Not known Details About Mortgage Broker Vs Loan Officer

You've most likely heard the term "mortgage broker" from your realty agent or good friends who have actually gotten a home. But what exactly is a home mortgage broker as well as what does one do that's various from, state, a funding officer at a bank? Nerd, Pocketbook Overview to COVID-19Get solutions to concerns about your mortgage, travel, financial resources as well as preserving your assurance.What is a mortgage broker? A home loan broker acts as a middleman between you and also possible loan providers. Mortgage brokers have stables of loan providers they work with, which can make your life easier.

The Of Mortgage Broker Meaning

Exactly how does a home loan broker obtain paid? Home loan brokers are most commonly paid by lenders, in some cases by customers, however, by law, never both. That law the Dodd-Frank Act Forbids mortgage brokers from charging concealed costs or basing their payment on a customer's passion rate. You can likewise choose to pay the mortgage broker on your own.The competition and home rates in your market will have a hand in determining what mortgage brokers charge. Federal law restricts how high payment can go. 3. What makes home mortgage brokers different from finance officers? Car loan policemans are workers of one lending institution who are paid set incomes (plus perks). Car loan officers can create only the kinds of finances their company chooses to use.

How Broker Mortgage Near Me can Save You Time, Stress, and Money.

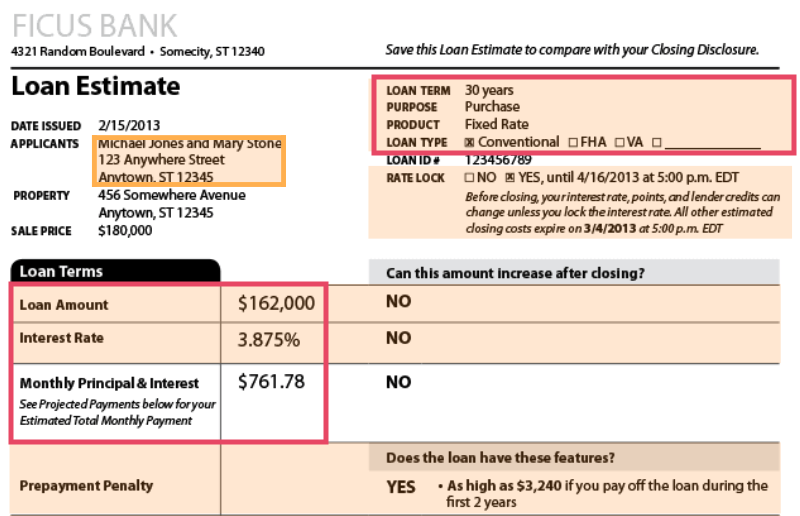

Home loan brokers may be able to provide consumers access to a wide selection of lending kinds. 4. Is a mortgage broker right for me? You can conserve time by utilizing a home mortgage broker; it can take hrs to make an application for preapproval with different lending institutions, after that there's the back-and-forth communication associated with financing the financing and also making sure the transaction remains on track.When picking any lending institution whether via a broker or directly you'll desire to pay attention to lending institution costs. Specifically, ask what fees will show up on Web page 2 of your Lending Price quote kind in the Lending Prices area under "A: Source Charges." After that, take the Financing Estimate you get from each lender, put them her latest blog side-by-side as well as compare your rate of interest price as well as all of the charges as well as shutting expenses.

The Best Guide To Mortgage Broker

Exactly how do I pick a home loan broker? The best means is to ask friends and loved ones for referrals, but make certain they have in fact used the broker as well as aren't just dropping the name of a former university flatmate or a remote colleague.

What Does Broker Mortgage Fees Do?

Competition and also residence costs will affect just how much home mortgage brokers obtain paid. What's the difference between a mortgage broker and also a funding police officer? Mortgage brokers will work with numerous loan providers to discover the most effective finance for your situation. Loan policemans benefit one loan provider. Exactly how do I discover a home mortgage broker? The most effective way to find a home loan broker is through referrals from family, close friends and also your real estate representative.

The Greatest Guide To Broker Mortgage Calculator

Acquiring a new home is among the most complicated occasions in an individual's life. Residence differ greatly in terms of style, features, institution district and, naturally, the constantly crucial "area, area, area." The mortgage application process is a difficult facet of the homebuying procedure, particularly for those without past experience.

Can figure special info out which problems could produce problems with one loan provider versus an additional. Why some buyers prevent home mortgage brokers In some cases homebuyers really feel extra comfy going straight to a huge financial institution to secure their finance. In that situation, buyers need to at least talk with a broker in order to understand every one of their options relating to the kind of financing and also the available price.

Report this wiki page